Ctc calculator 2021

3000 for children ages. The advance Child Tax Credit payments were signed into law as a part of the American Rescue Plan Act in 2021.

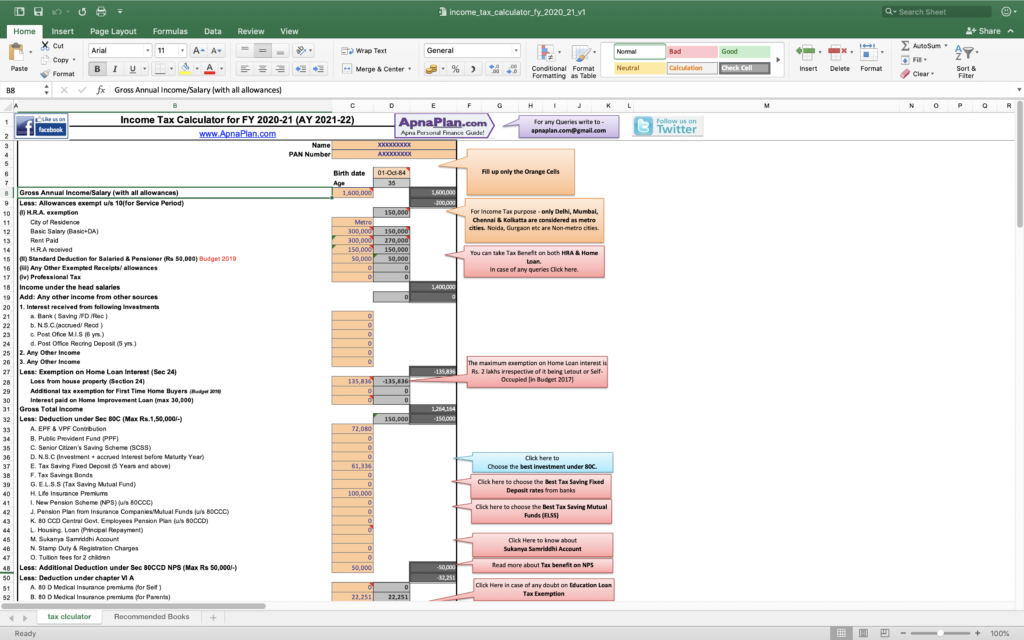

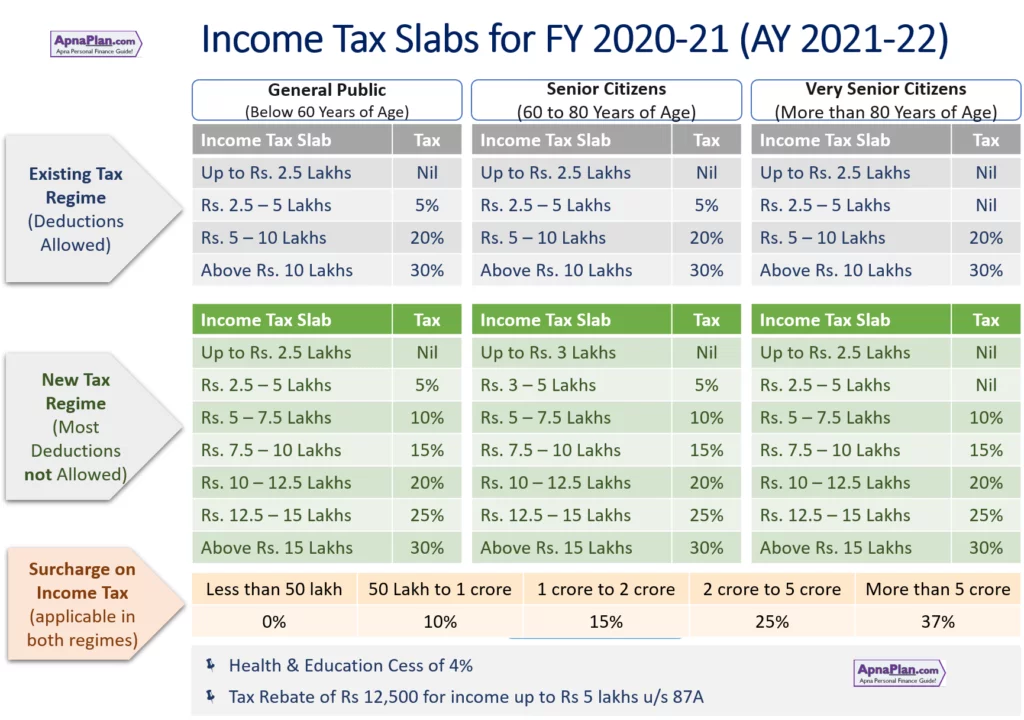

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

The American Rescue Plan Act ARPA of 2021 expands.

. 3600 for children ages 5 and under at the end of 2021. The other half will be credited against 2021 taxes and any money remaining will be paid directly to families. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements.

The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. Have been a US. The reliability of the results depends on the accuracy of the information you enter.

For 2021 eligible parents or guardians can. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in. It does not matter when during the year you.

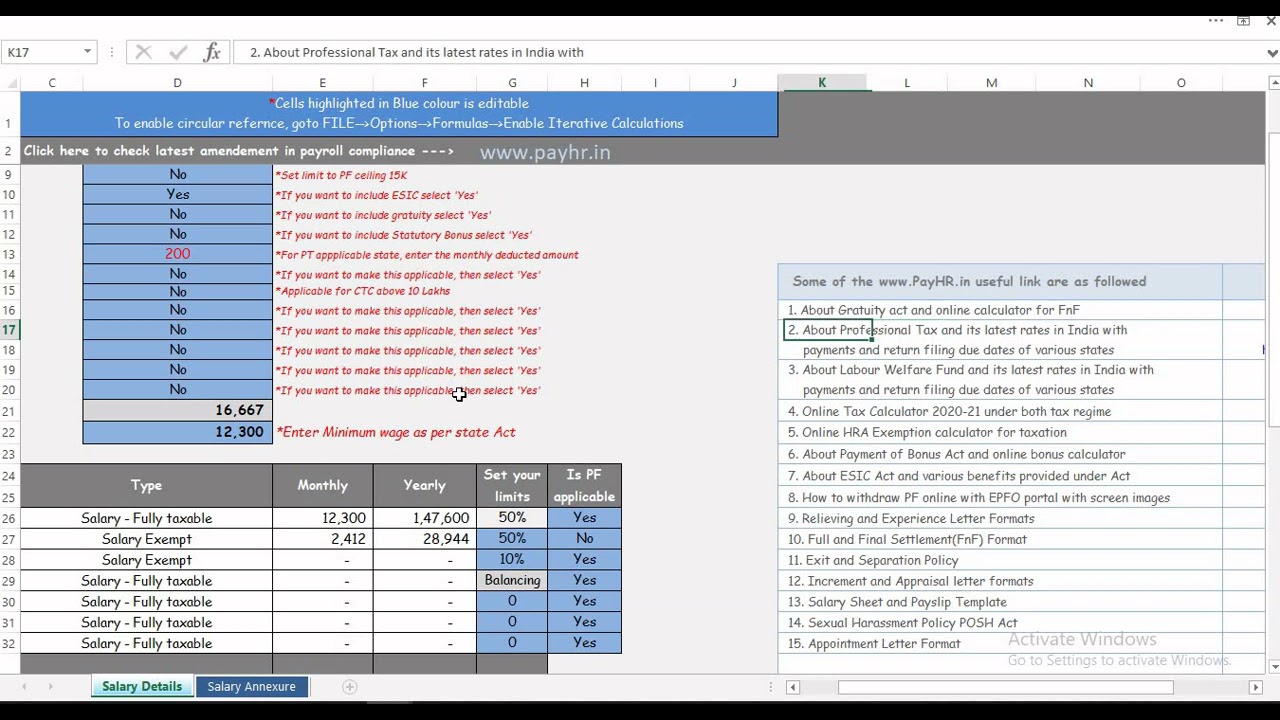

2021-04-01 About US PayHR provides tools for HR and Payroll professionals by providing online calculators for Income Tax Statutory Bonus HRA exemption CTC Salary. There have been important changes to the Child Tax Credit that will help many families receive advance payments. A childs age determines the amount.

If your child died on or after January 1 2021 you remain eligible to claim the 2021 Child Tax Credit for the full year and no action is required. This calculator is available for your convenience. An increase in penalty amount from.

The Child Tax Credit is intended to offset the many expenses of raising children. For example a family with a 4-year-old would be eligible for a credit of. The credit will be fully.

Earlier provisions for penalties and imprisonment were 1 year and fine of Rs10000 with minimum imprisonment of 6 months and fine of Rs5000. The tool below is to only be used to help. For Tax Years 2018-2020.

Remember to clear your Internet. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021.

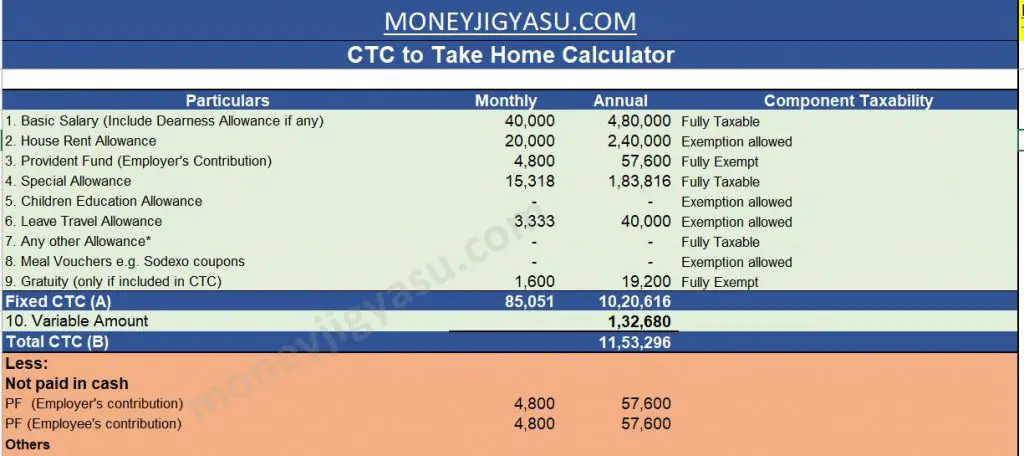

Salary Calculator Timelessimagephotos Com

Excel Ctc Calculator For Hr Professionals Payhr

Child Tax Credit U S Senator Michael Bennet

Ctc Vs Gross Vs In Hand Salary क तन कट ग प स Easy Salary Excel Calculation Youtube

Ctc Salary Calculator In Excel With Complete Payroll Setup Payroll Pedia

Excel Ctc Calculator For Hr Professionals Payhr

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Will The New Child Tax Credit Be Extended Forbes Advisor

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Salary Breakup Calculator Excel 2019 Salary Structure Calculator Breakup Salary Excel

Excel Ctc Calculator For Hr Professionals Payhr

In Hand Salary Calculator Hotsell Save 34 Www Mctconsultancy Com

What Will My In Hand Salary Be At Cognizant If My Ctc Is 7 16 Lpa Quora

What Will My In Hand Salary Be At Cognizant If My Ctc Is 7 16 Lpa Quora

Jfi Memo Cost Simulations Of A Fully Refundable Child Tax Credit Ctc 2022 2031

Ctc Salary Calculator In Excel With Complete Payroll Setup Payroll Pedia